Employees benefit as Group Risk industry pays record amount in claims during 2019. Here we take a closer look at the latest claims figures.

New figures released by the Association of British Insurers (ABI) and GRiD, the organisation that promotes the group risk industry show that the insurance industry as a whole paid out more than £5.7 billion in protection claims in 2019 – a year-on-year increase of over £470 million over 2018 – with the percentage of claims paid rising to 98.3%. This is the highest percentage of claims paid on record.

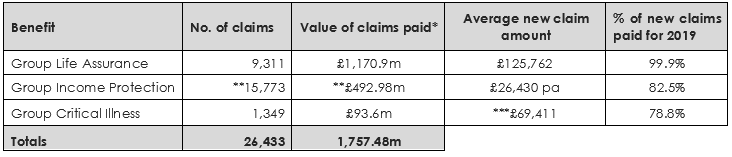

The data shows that employers are utilised group risk protection to provide financial support to a huge number of employees and their families during 2019 with a total of £1.76bn paid, an increase of £75 million over 2018. Thousands of UK employees and families (26,433) were helped to avoid financial hardship during the worst of times for them – after the death, illness or disability of a loved one.

Group risk insurers have helped people in many practical ways as well as making financial payments. In total 5,248 employees were helped back to work after a period of sick leave and there were 74,707 interactions during 2019 with the additional help and support services provided by group risk insurers.

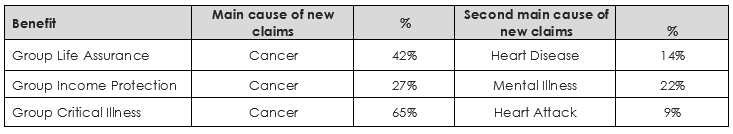

Cancer was the main cause of claim across all three group risk products during 2019, followed by either heart disease or mental health.

With over 98% of claims paid this will give reassurance to employers that their risk protection is effective and a confirmation that this protection should be a cornerstone of staff benefit planning.

Total claims paid and average new claim amounts

* All values are rounded **Total number of claims paid (new and existing) during 2019 and value of claims in payment as at 31 December 2019, including any claims paid for part of 2019. Group income protection claims are often paid for several or many years so the ultimate value of these benefits will be much higher. ***During 2019 there were 5,312 new group income protection claims, totalling £140.4m pa and averaging £26,430 pa.

Return to work facilitated for 5,248 employees within 2 years

For group income protection, as well as the claims paid, there are cases where employees are helped back to work both before and after a claim becomes payable, often with the support of the insurer, the employer or both.

GRiD has captured details of the cases where the insurer supported a return to work with active early intervention (such as fast-track access to counselling or physiotherapy, funded by the insurer) before that employee was eligible for a monetary payment.

3,415 people (34.7% of all claims submitted, down slightly by 1.6 percentage points on 2018) were able to go back to work during 2019 because of such early intervention (of which, 57% had help to overcome mental illness and 13% had support overcoming a musculoskeletal condition).

Of the new group income protection claims that went into payment during 2018, 1,833 people were helped by the insurer to make a full return to work during that year or during 2019.

Help and support

As well as paying claims and helping employees back to work, group risk insurers give access to everyday services that can be used to help and support a workforce on a day-to-day basis. This is via a number of ways, including:

- An associated Employee Assistance Programme

- Facilitating a second medical opinion

- Fast-track access to counselling, physiotherapy or other treatment

- Liaison and mediation

- Bereavement support and help with probate

- Access to healthcare apps and virtual GPs

In total, there were 74,707 interactions during 2019 with the additional help and support services that are funded by group risk insurers, giving daily value to employers regardless of whether or not a claim was made under their policy. Of these interactions, 37% involved access to counselling and 12% were related to family issues and 12% to employment matters.

Main cause of claim

Katharine Moxham, spokesperson for GRiD, commented: “As always, it’s great to be able to bring these numbers to life and to show the value of group risk benefits for employers, HR professionals, line managers and their people. 2019 was a year of political uncertainty but creating supportive workplaces and closing the disability employment gap continues to feature on the Government’s agenda. Group risk protection products can specifically help with this as the embedded support services that come with them can give employers a way of extending the help they can give to their people, especially for mental health.”

ABI’s Assistant Director, Head of Protection and Health, Roshani Hill

The ABI’s Assistant Director, Head of Protection and Health, Roshani Hill added: “The biggest ever pay out in protection insurance shows how vital this cover is for people who need support at a difficult time. The high number of claims paid should give people confidence they can trust that their insurance provider will be there when they need them, helping families get back on their feet and providing valuable safety nets when the worst happens.

“During uncertain times, when insurers are doing what they can to support individuals, families and the NHS, being able to have this confidence is more important than ever.”

If your organisation need assistance in ensuring your group risk is apt then, as independent specialists, advo can help. In the first instance email us on info@advo.co.uk.

Notes:

About GRiD Claims Data: The GRiD claims data survey was undertaken among its provider members and the figures provide an accurate representation of the current Group Risk market. Respondents provided figures for Group Life, Group Income Protection and Group Critical Illness claims for 2019.

You can view the GRiD press release in full here.